What is an IRA?

An individual retirement account (IRA) is a tax-advantaged investment account designed to help you save toward retirement. IRAs are one of the most effective ways to save and invest for the future. They allow your money to grow on a tax-deferred or tax-free basis, depending on the type of account (see the table below for details).

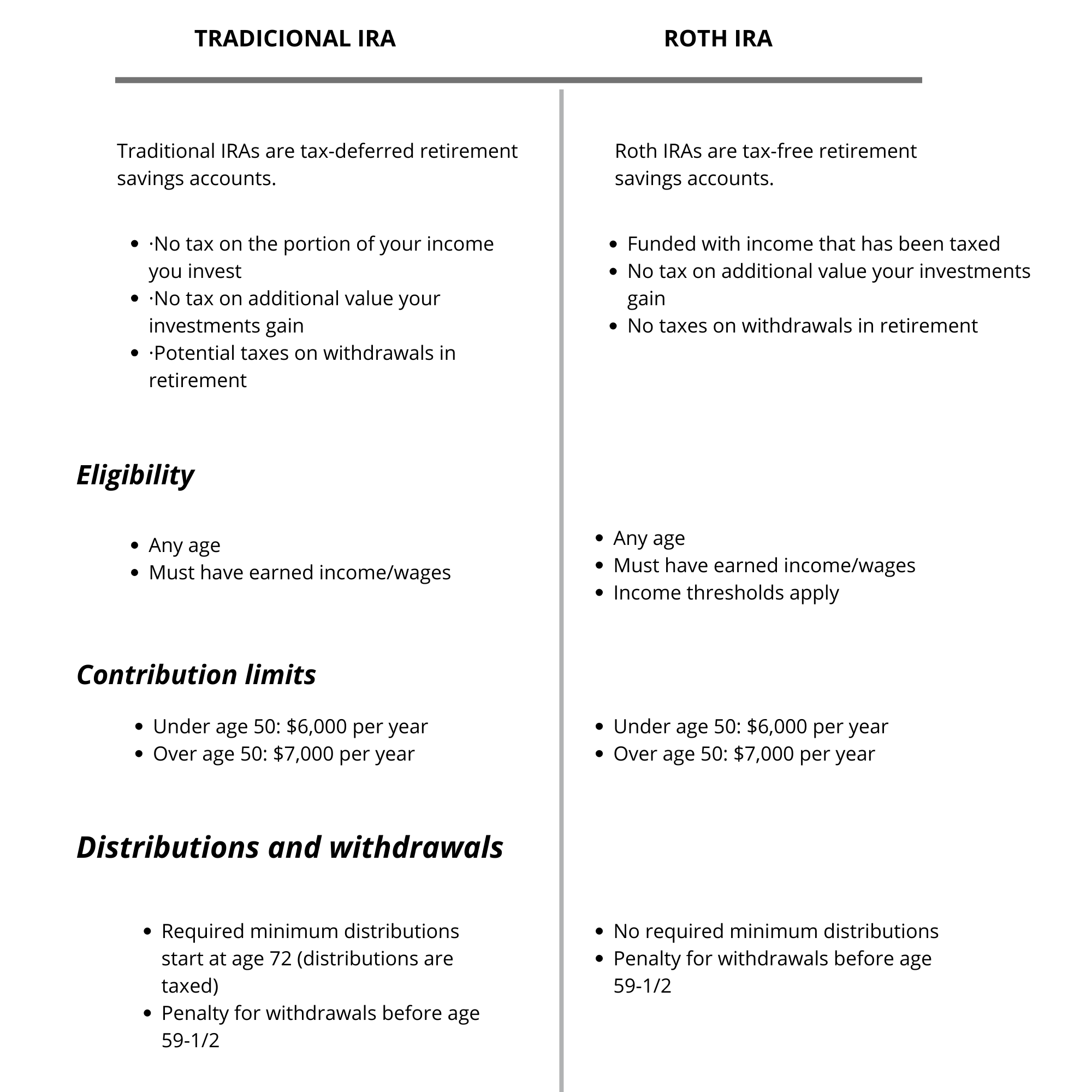

Traditional IRA

A traditional IRA is an individual retirement account that allows you to make contributions on a pre-tax basis (if your income is below a certain level) and pay no taxes until you withdraw the money. Starting at age 72, you’ll have to start taking required minimum distributions (RMDs) annually from your traditional IRA. Those withdrawals are taxed as ordinary income; however, if you withdraw the money before age 59½, you may also be subject to a 10% early-withdrawal penalty and state-tax penalties. .

Roth IRA

In contrast, Roth IRA contributions are made with after-tax dollars, and you won’t have annual RMDs. You can withdraw contributions to a Roth account anytime, tax- and penalty-free. But you can only withdraw your earnings tax-free after age 59½ as long as you’ve had the account for at least five years or you meet certain other conditions1—otherwise, you must pay taxes and penalties on them.

Roth IRA Advantages

A Roth IRA can offer flexibility in managing your taxes and expenses in retirement because you can withdraw money without increasing your tax bill, which could be helpful if, for example, you have a large, one-time expense after retirement.

Roth IRAs allow you to withdraw contributions at any time and for any reason without taxes or penalties, but just because you can do it doesn’t mean you should, especially if you’re fairly young. Taking money out of your Roth IRA means you may lose compounding earnings potential for retirement. And when you can only deposit $6,000 ($7,000 if you’re 50 or older) a year, it can be hard to get back the amount you withdrew

Finally, if your tax rate increases in the future or when you retire, contributing to a Roth IRA after taxes can add tax diversification to your retirement savings.

If you expect tax rates to increase in the future, either because your wealth and income will be higher in retirement or because of a change in tax law, consider Roth accounts.

Both Traditional and Roth IRAs are great long-term savings tools but, have distinct requirements, including eligibility and contribution limits so here is a guide to educate yourself on the differences and make an informed decision that fits your retirement goals.

How much can I contribute?

| IRA contribution limits | 2022 | 2023 |

| Traditional IRAs | Lesser of $6,000 or 100% of earned income | Lesser of $6,500 or 100% of earned income |

| Roth IRAs | Lesser of $6,000 or 100% of earned income | Lesser of $6,500 or 100% of earned income |

For starters, if an employer doesn’t offer you or your spouse a retirement plan, there’s no income limit on contributing to a traditional IRA and your contribution is fully deductible. However, if either of you participates in a workplace retirement plan, the deductibility phases out based on your marital status and income.

This table indicates whether your contribution to a Roth IRA is influenced by the amount of your modified AGI as computed for Roth IRA purpose

Should You Invest in a Gold IRA?

Many investors choose gold as a way to diversify their portfolio, either by investing in a gold IRA or by directly purchasing the metal. While gold can certainly have a place in a well-diversified portfolio, it is important to balance the risks of buying gold compared to other assets.

When saving for retirement, it is important to choose assets that will provide a return over time. Unlike stocks and bonds, gold does not pay any dividend or yield to the owner. The only opportunity for profit comes from the appreciation of the gold price itself. Gold values have historically outpaced inflation and doubled in value every 10 years.

How Do You Buy Gold in an IRA?

There are two ways to invest in gold through an IRA. One way is to set up a self-directed gold IRA, which allows you to buy physical gold and silver with retirement funds. It is also possible to invest in a mutual fund or ETF that invests in precious metals, although this is not the same as owning physical bullion.

What Is IRA Eligible Gold?

In a gold IRA, you can invest in certain gold assets. You can invest in legal tender bullion coins in a gold IRA, as long as they have a fineness of 99.5% or better. Bullion bars and rounds are also permissible, as long as they possess a fineness greater than 99.9%.

Prudential Metals Group’s Investment Process:

Build your future with experts guidance

1 Open An Account

Our account manager will assist you in completing an application to initiate the process. Once you have your account set up, we will link you with a precious metals IRA custodian.

2 Sign Transfer Document

Leave the complexities to us as we facilitate the transfer of funds for you. We collaborate directly with the precious metals custodian to rollover assets from your 401(k) or IRA to your Prudential Metals Group account.

3 Acquire Precious Metals

Delve Into Gold Investments

Investing in gold offers a unique blend of comfort, security, and potential for substantial long-term value appreciation. As a time-tested store of wealth, gold provides a reassuring sense of stability amid economic uncertainties and market fluctuations.

YOU MAY ALSO LIKE !!