Gold bars

8 key reason why gold bars are a smart investment.

More commonly known as bullion—are a popular choice for people looking to buy gold. Bullion is typically sold by gram or ounce, and the purity, manufacturer and weight should be stamped on the face of the bar.

Purity is very important when buying gold: Investment-quality gold bars must be at least 99.5% pure gold. C

You can buy gold bars from dealers, individuals or online . And keep in mind that you may be on the hook for delivery fees—plus insurance—to assure the safe transport of your bullion.

Investing in a gold bar, as already indicated at the beginning, can be a refuge value in troubled economic and stock market moments. Of course, it must be taken into account that its acquisition involves a much higher outlay than the acquisition of some other assets. Therefore, it is convenient to opt for the most appropriate and secure channel before acquiring one of them.

The Eight Main Advantages Of Investing In Gold Bars

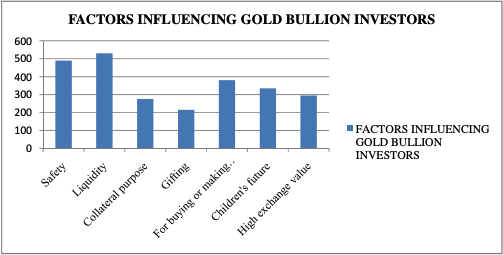

Security of investment in gold bars :

Above all, purchasing gold enhances investment security, as its value has remained consistently esteemed throughout history. This applies whether we invest in gold coins, such as the South African Krugerrand, or acquire bullion from private companies or public banks.

Value stability:

Although, obviously, the price of gold in coins or gold bars fluctuates over time, its value maintains greater stability than the stock values of most markets in the world, since its upward variations or downward are usually smoother. than those of other assets. This is especially true if we look at the stock over long periods of time, where its weighting shines for its stability.

Weakness of the U.S. Dollar:

When the Dollar Index rises, that is, when the US currency increases in value, the price of gold, which is denominated in dollars, falls. Conversely, when the dollar falls, the price of gold rises.

Also, if the dollar loses value, investors get nervous and start looking for alternative investment assets that act as a safe haven. And gold is one of the main ones.

The truth is that, between both assets, the only one that has intrinsic value at any time and situation is investment gold.

Liquidity:

The gold bars can be easily converted to cash anywhere in the world. Apart from actual cash, the liquidity and universality of gold is unrivaled.

Inflation hedge:

Gold has historically been an excellent inflation hedge, because its price tends to rise when the cost-of-living increases. Over the past 50 years, investors have watched gold prices soar and the stock market crash during years of high inflation. This phenomenon arises because, with the depreciation of purchasing power in fiat currency due to inflation, gold tends to acquire higher valuation in those currency units, resulting in a proportional increase. Furthermore, the perception of gold as a dependable store of value motivates individuals to contemplate acquiring gold when they detect a decline in the value of their local currency.

Prestige recognized throughout the world:

It is an asset that can be sold in absolutely all markets in the world, where it is always adequately valued. There are even markets, such as China and Asia in general, where investing in gold is more valued than in Western markets. This means that wherever we are, we can always sell them.

Increasing Demand:

In previous years, rising wealth in emerging market economies increased demand for gold. Many of these countries, gold is an integral part of the culture. In China, gold bars are a traditional form of savings and the demand for gold has remained constant. India is the second most gold-consuming nation in the world; it has many uses there, including jewelry. As such, the Indian wedding season in October is traditionally the time of year that fuels the highest global demand for gold.

An increasing number of investors are turning their attention to commodities, specifically gold bars, as a viable investment class for allocating funds. In fact, SPDR Gold Trust (GLD) has become one of the largest and most frequently traded exchange-traded funds (ETFs) in the United States.

Extraordinary demand from central banks, the highest in 55 years, along with a busy fourth quarter despite rising prices, drove the significant annual increase. A report from the World Gold Council on the trade of this precious metal throughout 2022 indicates these factors.

Portfolio Diversification:

Diversifying a portfolio involves allocating capital across various asset types or financial instruments that lack strong correlations with one another. That is, a diversified portfolio will include positions of different types of assets

Incorporating gold-linked assets into investment portfolios represents an interesting alternative to hedge against negative scenarios such as a recession in stocks. Without a doubt, the investor should contemplate it..

Delve Into Gold Investments

- Why Gold and Silver are important

- Why Gold IRA is a Smart Retirement Strategy

- The Benefits and Risk of Investing in Gold Bars

- How to Buy and Store Gold Bars Safely

- Gold Bars vs. Gold Coins

- Do You Know About the Monster Box?

- A Beginner’s Guide to Gold IRA Investments

Invest with confidence at Prudential Metals Group, the source for valuable information on buying gold bars, understanding the melting point, and setting up a Gold IRA.

RECOMMENDED FOR YOU!