Unveiling the Distinctness: White Gold vs. Platinum

Did you know the difference between white gold and platinum and why they are so easily confused and compared? Professionally compare white gold vs. platinum, learn why certain people choose one over another. Find out which is best for you!

White gold and platinum are two metals found in deposits in different parts of the world. Their color and appearance are very similar, making it difficult to distinguish between the two materials at first glance. but one is much more common than the other. In this case, platinum is a scarcer material than gold, since it barely has a total of 200 tons compared to more than a thousand for gold.

This scarcity renders platinum one of the most sought-after and expensive metals, making it an enticing option for astute investors seeking long-term gains amid increasing demand and limited supply.

Currently white gold is very fashionable and is one of the most demanded metals when looking for a jewel

This article delves into the technical distinctions between white gold and platinum, highlighting their differences and the reasons for frequent confusion.

Platinum: A Precious Metal with Diverse Applications

Platinum is a precious metal that belongs to the platinum group elements (PGE), which also includes palladium, rhodium, ruthenium, iridium, and osmium. Here are some key points about platinum:

The rarity and intrinsic value of platinum make it an alluring investment option. As an essential component of diversified portfolios, platinum provides a hedge against inflation and economic fluctuations. Investors seek security in the finite nature of this precious metal, finding solace in its resilience amidst global geopolitical concerns.

Rarity and Value

Platinum is one of the rarest elements on Earth, much rarer than gold. Its scarcity contributes to its high value and makes it one of the most precious metals in the world.

Physical Properties

Platinum is a dense, malleable, and ductile metal. It has a silvery-white color, which gives it a lustrous appearance. It has a high melting point of around 1,768 degrees Celsius (3,214 degrees Fahrenheit), making it suitable for high-temperature applications.

Industrial Uses

Platinum is highly valued in various industries due to its exceptional properties. It is commonly used in catalytic converters for automobiles, helping to reduce harmful emissions from the exhaust gases. Additionally, it is used in the chemical, electrical, and electronics industries, as well as in medical and dental applications.

Jewelry

Platinum is also popular in the jewelry industry. It is often alloyed with other metals to increase its durability, as pure platinum can be relatively soft. Platinum jewelry is considered prestigious and is known for its elegance and durability.

Investment and Finance

Like other precious metals, platinum is traded on commodity markets and can be used as an investment. It is often seen as a hedge against inflation and economic uncertainty.

Historical Significance

Platinum has a fascinating history. It was used by pre-Columbian South American cultures to create artifacts, and it was initially considered a nuisance by Spanish conquistadors as it interfered with gold mining. However, it gained popularity in Europe in the 18th century for its unique properties.

Platinum Coins and Bullion

Some countries mint platinum coins for collectors and investors. Platinum bullion is available in various forms, including bars and coins, and its value is typically tied to the current market price.

Allergy-friendly

One of the advantages of platinum in jewelry is that it is hypoallergenic. Unlike some other metals, platinum rarely causes allergic reactions, making it a popular choice for those with sensitive skin.

Overall, platinum’s rarity, versatility, and enduring beauty have cemented its place as a highly sought-after and valued metal in various fields, from industry to jewelry and investments.

Why are investors choosing platinum?

Investors choose platinum for various reasons, mainly due to its unique properties and its role as a precious metal. Here are some of the key reasons why investors choose platinum:

It is for them that platinum, being one of the most demanded metals and therefore one of the most expensive, is the option that an investor would choose, it is usually a very good long-term investment with recent demand and little supply. Platinum has great appreciation potential as more and more uses are attributed to it, while its production does not increase in proportion.

Store of Value

Like other precious metals, platinum is considered a store of value. It has intrinsic worth and is not tied to any specific currency or government, making it a hedge against inflation and economic instability. Investors often turn to platinum to protect their wealth during times of economic uncertainty.

Diversification

Investors use platinum to diversify their investment portfolios. Diversification involves spreading investments across different asset classes to reduce risk. Including precious metals like platinum in a portfolio can provide an added layer of diversification, as its performance may not be directly correlated with the performance of other investments like stocks or bonds.

Limited Supply

Platinum is a rare metal, with limited global supply. Its scarcity enhances its value, and some investors view it as a safe haven asset due to its finite nature.

Industrial Demand

Platinum’s unique physical and chemical properties make it highly valuable in various industrial applications, such as catalytic converters, chemical processing, and electronics. As industrial demand for platinum increases, investors may see potential for price appreciation.

Jewelry Market

Platinum’s popularity in the jewelry industry can influence its demand and price. As consumer preferences shift towards platinum jewelry, it can positively impact the metal’s investment appeal.

Geopolitical Concerns

Geopolitical tensions and global uncertainties can drive investors to seek refuge in precious metals like platinum. During times of geopolitical instability, investors may view platinum as a safe asset that retains value.

Investment Vehicles

There are several ways for investors to access the platinum market. They can buy physical platinum in the form of bars or coins, invest in platinum exchange-traded funds (ETFs), or trade platinum futures contracts on commodity exchanges.

Speculation

Some investors may choose platinum as part of their speculative strategies, betting on potential price movements to generate profits in the short term.

It’s important to note that while platinum has many advantages as an investment, it also carries risks. Like all commodities, its price can be affected by factors such as changes in industrial demand, economic conditions, and investor sentiment. As with any investment decision, investors should carefully consider their financial goals, risk tolerance, and conduct thorough research before including platinum or any other asset in their portfolio.

Extraction of Platinum:

Technically, platinum is extracted from its ore through a process called “refining,” which involves several steps. Here’s an overview of the extraction process and some of the main uses of platinum:

1. Mining: Platinum is primarily obtained from mines, typically in the form of ores containing platinum group elements (PGEs). These ores may also contain other valuable metals such as palladium, rhodium, and gold.

2. Crushing and Grinding: The mined ore is crushed and ground into a fine powder to increase the surface area, making it easier to extract the platinum and other PGEs.

3. Froth Flotation: The powdered ore is mixed with water and chemicals in a process called froth flotation. The mixture is agitated, causing the valuable minerals, including platinum, to attach to air bubbles. These bubbles rise to the surface, where they are collected, while the unwanted materials sink.

4. Smelting: The collected material, known as concentrate, undergoes smelting, a high-temperature process that separates the platinum-containing material from other impurities. The result is a molten mixture of metals, known as “matte,” which contains platinum, palladium, rhodium, and other base metals.

5. Refining: The matte is then further processed through a refining process. One common method for platinum extraction is known as “hydro-metallurgical refining.” In this process, strong acids treat the matte, dissolving the base metals and leaving behind a platinum-rich residue. Subsequently, the platinum is further processed to extract it in its pure form.

Uses of Platinum:

The unique properties of platinum, combined with its various applications in critical industries, contribute to its high value and importance in today’s world.

- Catalytic Converters: One of the most significant uses of platinum is in catalytic converters, which are essential components in automobile exhaust systems. Platinum acts as a catalyst, facilitating chemical reactions that convert harmful pollutants in exhaust gases (such as carbon monoxide, hydrocarbons, and nitrogen oxides) into less harmful substances like carbon dioxide, water, and nitrogen.

- Chemical and Petroleum Industries: Platinum is used as a catalyst in various chemical and petrochemical processes. It helps speed up reactions and increase the efficiency of processes like hydrogenation and dehydrogenation.

- Electronics: Platinum is utilized in the electronics industry for various applications, including electrical contacts, electrodes, and some specialized components in electronic devices.

- Medical and Dental Applications: Platinum and its alloys find use in certain medical devices, including pacemakers, stents, and dental prosthetics. Due to its biocompatibility, platinum is well-tolerated by the human body.

- Jewelry and Investment: Platinum’s beauty, durability, and rarity make it a popular choice for fine jewelry. Additionally, as mentioned earlier, investors often acquire platinum as a precious metal investment or as part of a diversified portfolio.

White Gold

Pure gold is slightly reddish yellow in color. When we use the term ‘pure’ when speaking about precious metals it refers to the quality of the metal. 100% pure gold, in practice, is 99.9% or better. Gold bullion and bullion coins maintain this 99.9% purity standard for investment and financial holdings vs other cash or exchange traded investments.

When we deviate from the pure 99.9% we do so for industrial and jewelry applications of the metal. When speaking of gold in jewelry we can also use the term Karat. Pure gold, by definition, is 24 karats. So, all colored golds are less pure than this commonly 18K (75%), 14K (58.5%), 10k (41.6%), and 9k (37.5%).

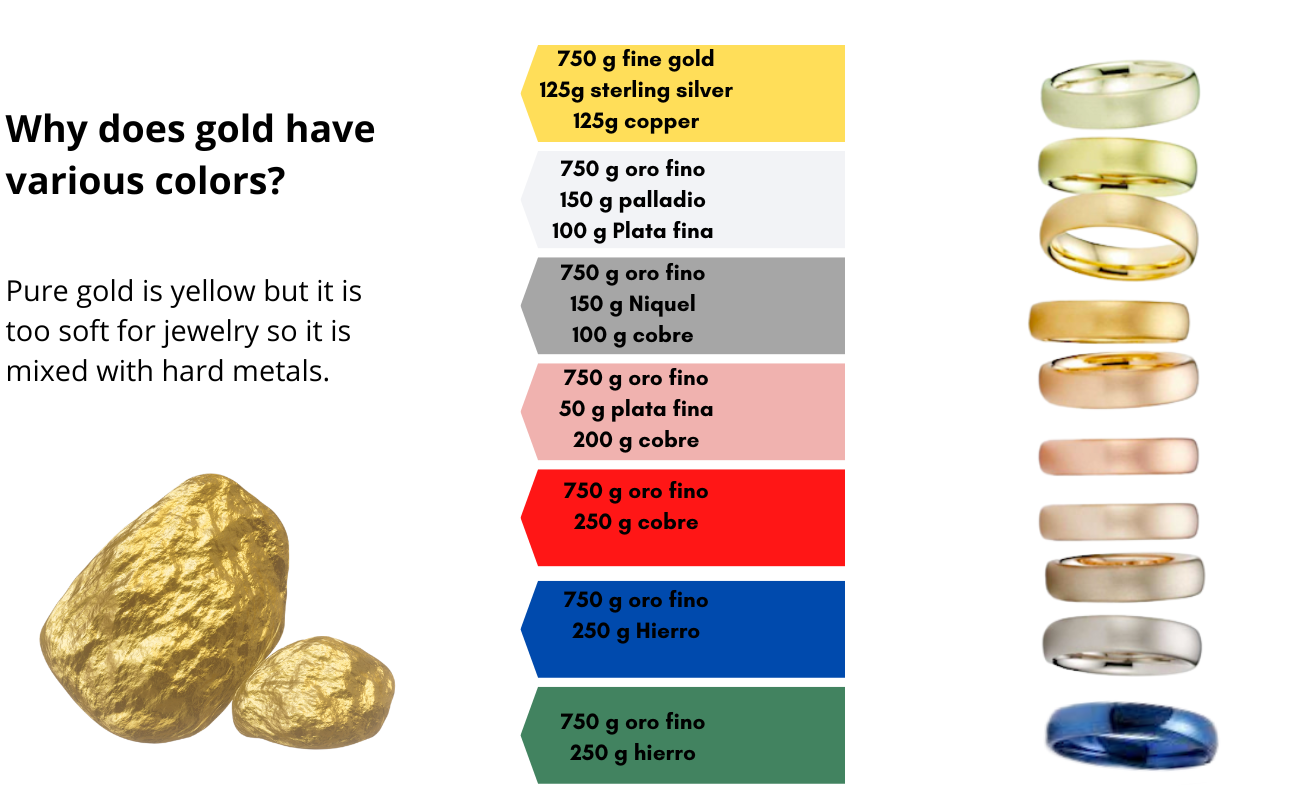

Composition and Color

White gold comprises an alloy blend of gold and at least one white metal, typically nickel, silver, or palladium. Its initial purpose was to emulate the luster of platinum. The usage of “white gold” in the jewelry sector is somewhat broad, denoting the whitish shade. A prevalent formulation for white gold involves 75% gold combined with 25% nickel and zinc by weight. The color of white gold can vary from faint yellow to subtly brown or pale rose, often concealed through rhodium plating of the final piece to achieve the desired shine and color perception for white gold.

The nickel used in some white gold alloys can cause a mild allergic skin reaction when worn for long periods of time. Gold in its pure form is a soft pliable metal. Other metals are added to change colors and to harden the finished product. Gold alloys can be found in many other colors such as bright yellow, rose, red, pink and even purple or blue depending on the alloy mix.

White gold is an alloy and not a precious metal that exists on its own. Jewelry is a symbol of wealth and a fashion statement and should not be confused with investing in precious metals. When investing in precious metals it is advised that the investor purchase precious metals in the purest bullion form of 99.9% purity. Invest in bullion and bullion coins in gold, silver, platinum and palladium.

You can have coins or bullion in a precious metals IRA account. Despite the colloquial term “gold IRA”, you can have silver, platinum and palladium in this account.

The IRS has minimum requirements for the fineness of the metal, along with specifications for type, size, and weight. Gold approved by the IRS must be 99.5% pure. Silver must be 99.9% pure. Platinum and palladium must be 99.95% pure.

Continue riding >>…

Investing In Precious Metals With Your 401(K) Or IRA

Throughout history, during turbulent economic times, precious metals have maintained their value which makes them a prudent choice for saving for retirement.

Bonds, stocks and mutual funds are often placed directly into retirement accounts such as 401(k)s.

Gold, as well as its cousin silver, also palladium and platinum are rich with industrial applications, provide other options.

By including precious metals in your retirement savings, you can lower your risk by diversifying away from paper assets. Paper assets are generally known to be unstable when the stock market crashes.Portfolio diversity also gives you a hedge in the event of economic downturn or inflation.

YOU MAY ALSO LIKE!