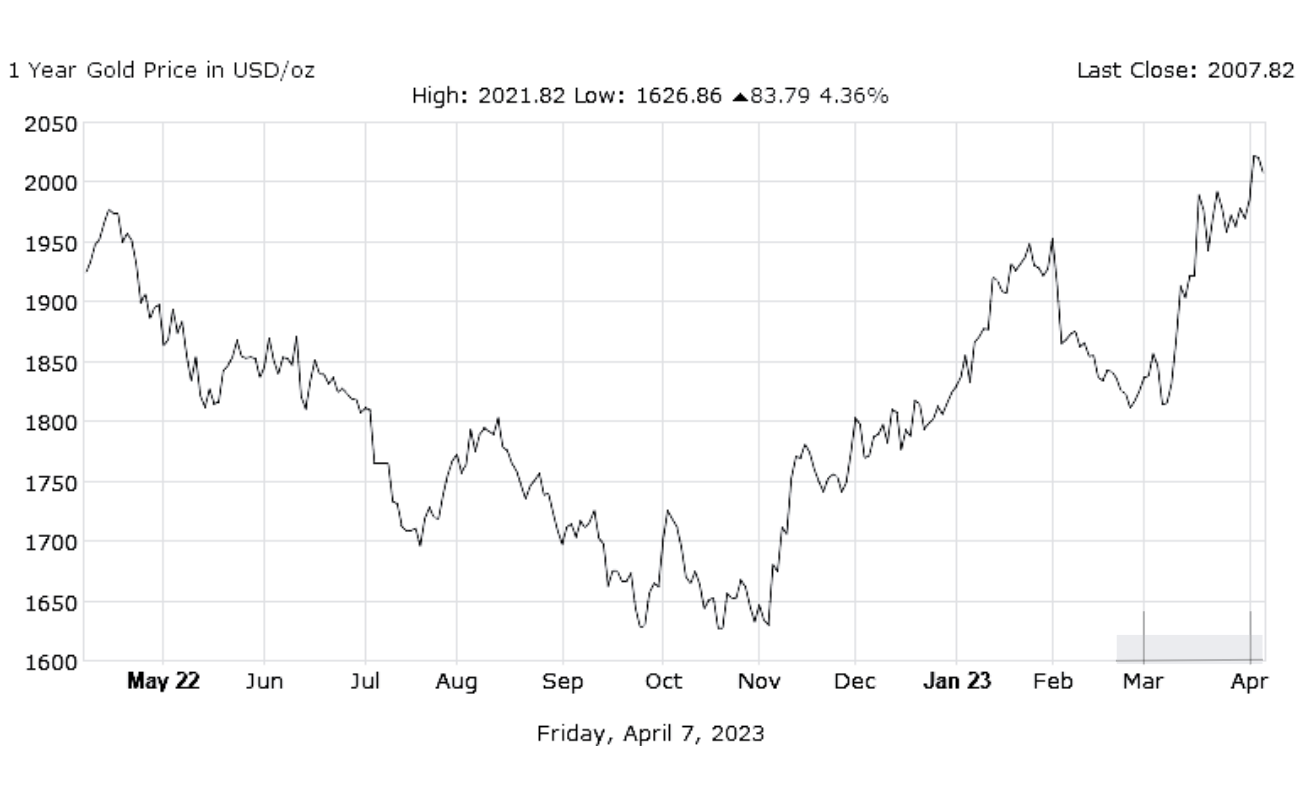

What happened with the price of gold over the last year?

By the end of December 2022 it was difficult for gold to defend the 1800 dollars that it had not seen since July 2022

Although there was optimism generated by the US Federal Reserve, bringing forward last week a smaller rise (of 50 basis points) at the December 2022 meeting, gold was short-lived. where it once again touched $1,800 per ounce, levels at which it had not been listed since July 2022 and with which it managed to rebound around 11% from the lows for the year marked on September 26, at $1,622.

Today Gold rises to $2,080, the highest since the Russian invasion, between the search for refuge and excessive speculation with US bonds

Gold continues to rise

The precious metal has approached its all-time high in recent hours above 2,070 intraday dollars per ounce in August 2020. This Wednesday it is trading above 2,000 dollars and is also close to 2,070 marked at the beginning of March 2020. last year, in the early stages of the Russian invasion of the Ukraine. The background vector that unites these milestones seems to be fear – uncertainty after the outbreak of the covid and before the discovery of the vaccine, war on European soil, fear of a banking crisis – and the consequent search for refuge, but analysts ask to scratch on the surface.

The troy ounce of gold appreciated 2% yesterday at the European stock market close and deepened a few tenths more in that rise at the start of the session this Wednesday to $2,041 for the first time since the beginning of the war in Ukraine, in March of 2022, due to the weakness of the dollar and the expectations that the aggressive monetary policy of the Federal Reserve (Fed) is coming to an end

According to experts and information from Bloomberg, the revaluation of the metal spurred on Tuesday is due to the fall in the “green money” and the largest decline in jobs offered in February since May 2021 (JOLTS survey), for which reason discounts the end of interest rate hikes. Gold, experts explain, maintains an inverse correlation with the dollar, increasing or decreasing its value depending on the strength of the US currency.

The price of gold has crossed the level three times

According to market data, gold has exceeded the $2,000 level three times since the beginning of last March due to the banking crisis that broke out, both in the US and in Europe, due to the bankruptcy of Silicon Valley Bank (SVB) and the takeover of the Swiss Credit Suisse by UBS. Since these shocks began in the financial system, they have driven investors closer to refuge values such as debt or metals, while equities have suffered. As a result, gold has experienced an impressive 11% revaluation, matching its appreciation throughout the year.

Gold reached its all-time high in August 2020, when it traded at $2,075, and with the invasion of Ukraine in March 2022, it reached as high as $2,070.

Only the S&P 500 and housing beat gold over the long term

and as if it were a risky asset, gold has risen almost 20% since the end of October. The price of an ounce of gold rises 6% in the year and continues the historical series. Not surprisingly, in 8 of the last ten years, its price has risen in the first month of the year, which has become the most bullish of the year historically speaking if the average of the last 30 years is taken into account.

One of the consequences of falling sovereign debt yields and a weak dollar is renewed investor interest in precious metals, which are often the market’s favorite option in a financial crisis.

FIND A SAFE WAY TO INVEST IN GOLD

Gold has consistently proven to be a trustworthy and resilient asset, maintaining its value throughout history, even during times of economic crisis. As a smart investor, it is crucial to diversify your assets and consider options that offer stability and protection against inflation and market volatility.

At Prudential Metals Group, we understand the importance of financial planning to ensure long-term stability and security.

YOU MAY ALSO LIKE!!